Summary: Learn how to do basic bookkeeping to keep track of your business costs.

How to do basic bookkeeping

Bookkeeping is normally seen as the less fun aspect of your business.

However, like accounting, the core of any business lies in bookkeeping.

When starting a business, it is important to understand how to perform basic bookkeeping tasks to keep track of the costs and keep them low as well. After all, it is your business and understanding how profit is created will make it easier for you to expand your operations.

Luckily, bookkeeping can be learned by following these three simple steps:

- Keep receipts or other records of every payment to and every expenditure by your business.

- Summarize your income and expenditure records on some periodic basis (daily, weekly, or monthly).

- Create financial reports based on the summaries to tell you specific information about your business such as how much monthly profit you are making.

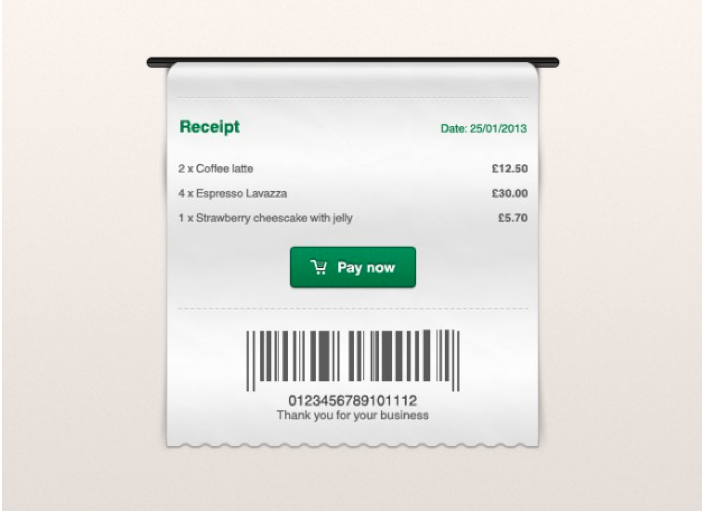

Keeping Receipts

Image: Freepik

Each of your business’s sales and purchases must be backed by some type of record that contains the amount, the date, and other relevant information about that sale.

For instance, when buying products, a business gets a purchase invoice from the supplier. When a customer uses a credit card to buy the business’s product, the business gets the credit card slip as proof of transaction. When preparing payroll cheques, a business depends on salary rosters and time cards.

All of the records above serve as sources of information into the bookkeeping system. In other words, information the bookkeeper uses in recording the financial effects of the business’s activities.

The more sales and expenditures your business makes, the better your receipt filing system needs to be.

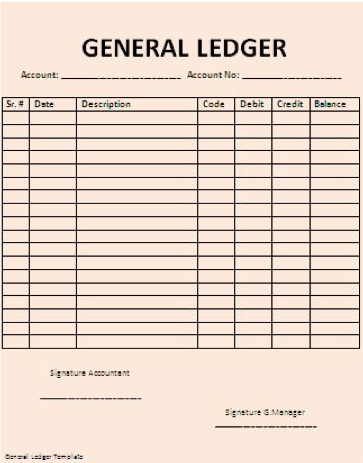

Setting Up and Posting to Ledgers

Image: Professional Templates

You should transfer the amounts from your receipts for sales and purchases into your ledger the moment you have them.

You should post receipts on a regular basis like every day, once a week, or at least once a month depending on the pace of your business. For instance, a retail store that does hundreds of sales amounting to thousands of dollars every day should post daily. With that volume of sales, it is important to see what is happening everyday and not to fall behind with the paperwork.

A slower business, on the other hand, that has very few large transactions in a month would probably requires a weekly or monthly posting.

Generally speaking, the more sales you do, the more often you should post to your ledger.

Basic Financial Reports

Image: Freepik

While this falls into an accountant’s responsibility, a bookkeeper can prepare a basic financial report for business owners to catch a glimpse of the business’s current financial status.

Financial reports are important because they bring together several key pieces of financial information about your business. Financial reports will combine the date from your ledgers and turn into graphs or pictorials that show you the big picture of your business. The key reports you need to create regularly are cash flow analysis, profit and loss forecast, and balance sheets.